STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries.

STR and Tourism Economics have upgraded the 2023 U.S. hotel forecast just presented at the 45th Annual NYU International Hospitality Industry Investment Conference.

While top-line performance advances, growing operating expenses are projected to limit profit growth over the remainder of the year.

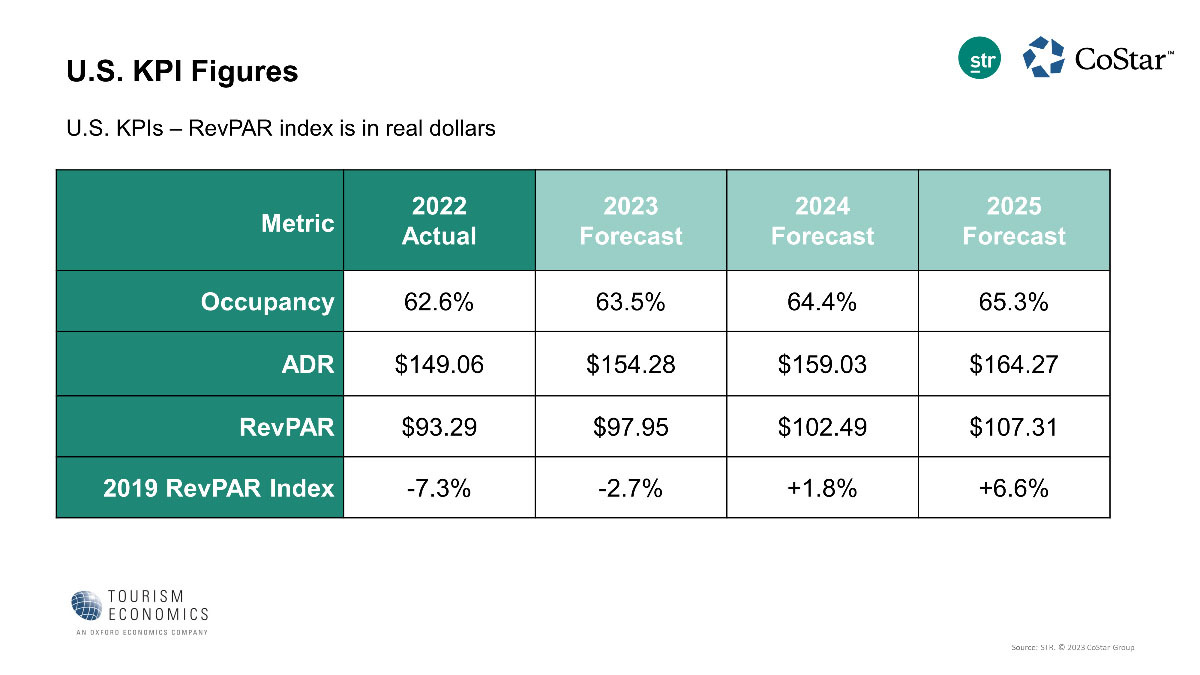

Occupancy: lowered 0.2 per cent from the previous forecast

Average Daily Rate (ADR): lifted 1.5 per cent

Revenue per available room (RevPAR): lifted 1.3 per cent

For 2024, a 1.4 per cent downgrade in occupancy coupled with a 0.7 per cent lift in ADR meant a RevPAR downgrade of 0.6 per cent. RevPAR, the key top-line performance metric, was fully recovered in 2022 on a nominal basis but will not achieve that status when adjusted for inflation (real) until 2025. Gross operating profit per available room (GOPPAR) was also recovered in 2022 with limited growth forecasted for 2023 and more sizeable gains projected in 2024. The GOPPAR projection for this year was lowered 2.7 per cent from the previous forecast and downgraded 4.0 per cent for 2024.

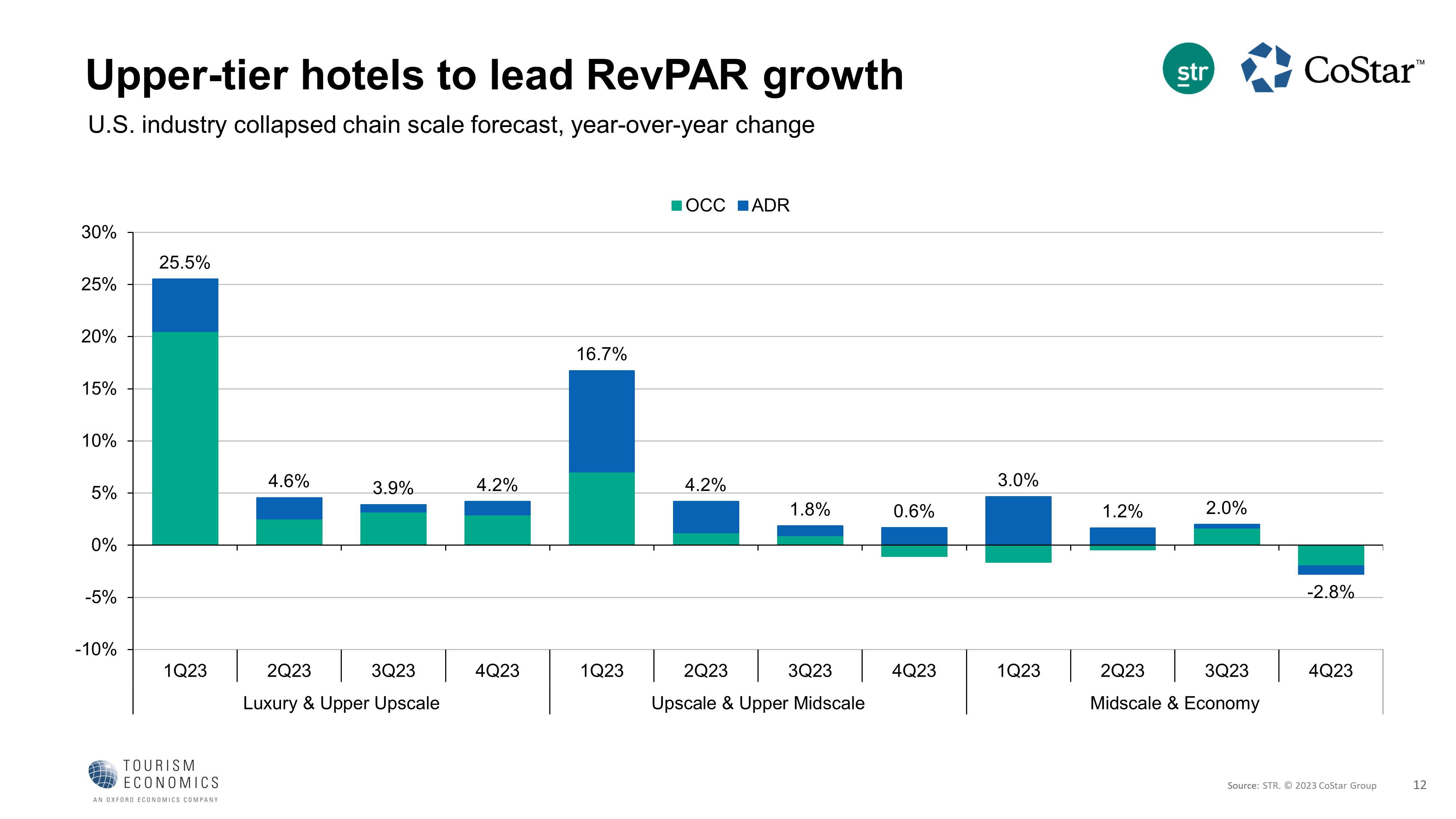

“Despite the upgrade, economic uncertainty underlines our forecast for the remainder of this year and into 2024,” says Amanda Hite, STR president. “We have always forecasted a mild recession in mind, but we're now looking at a later timeline and the added concerns around the banking system. Regardless, in the first four months of the year, hotel demand improved 4.3 per cent with most of the gain concentrated in the upper upscale and upscale chains. These two chains, which are the segments most associated with business travel and groups, are expected to lead industry demand growth for the remainder of 2023. With everything considered, the industry has plenty of reasons to remain optimistic about top-line performance. At the same time, growing operating expenses, especially labour, continue to pressure the bottom line. Profit margins, while strong, are projected to be lower this year than last.

“Recent stress in the banking system and tighter lending standards will add to inflation pressures and produce a relatively mild recession in the second half of 2023,” says Aran Ryan, director of industry studies at Tourism Economics. “A halting economy will limit gains in lodging demand, though we continue to anticipate returning group and business activity, international travel, and consumers’ desire for travel will sustain modest growth in room nights sold.”

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base with direct access to the most comprehensive set of historic and forecast travel data available. And our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models.

InnVest Hotels has acquired The Algonquin Resort St. Andrews by-the-Sea, Autograph Collection and The Algonquin Golf Course.

The new owners of the famed Windermere House hotel and resort on Muskoka’s Lake Rosseau intend to revitalize the building and its amenities while preserving the property’s historical integrity.

Proactive Hospitality has acquired the Coast Osoyoos Beach Hotel, B.C. CFO Capital arranged acquisition financing for the deal.

Tribute Portfolio – part of Marriott Bonvoy's extraordinary portfolio of 31 hotel brands – continues to grow its global family of characterful hotels with Honeyrose Hotel Montreal, a Tribute Portfolio Hotel, the brand's…