InnVest Hotels acquires The Algonquin Resort St. Andrews by‑the‑Sea, Autograph Collection and The Algonquin Golf Course

InnVest Hotels has acquired The Algonquin Resort St. Andrews by-the-Sea, Autograph Collection and The Algonquin Golf Course.

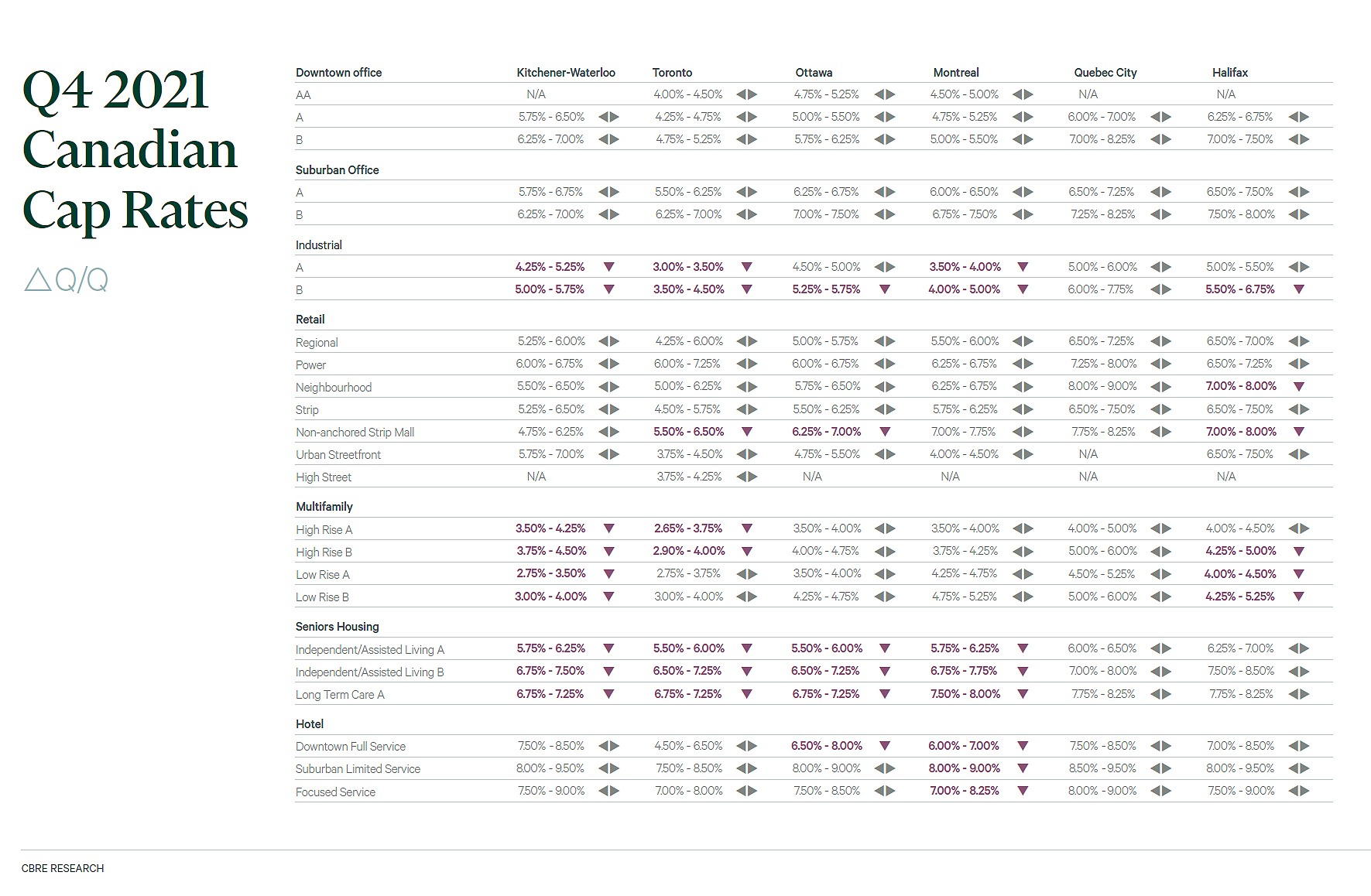

Q4 2021 Canadian cap rates and investment insights CBRE Hotels.

Investment insights from Mark Sparrow, executive vice president of CBRE Hotels.

Investment Trends from Paul Morassutti, vice chairman, Valuation & Advisory Services

The Canadian commercial real estate investment market continued its run of impressive performance in Q4 2021. Single asset investment activity was once again exceptionally robust and the quarter also saw the return of M&A activity with several significant portfolio transactions and REIT privatizations closing over the period. National volumes are poised to set a new annual record in 2021, surpassing the $50.0 billion benchmark by a significant margin.

Cap rates declined across nearly all asset classes in Q4 2021. Given compressed cap rates for industrial and multifamily properties, investors have become increasingly willing to consider retail, office, and alternative assets in a search for yield.

Q4 2021 Cap Rates: Hotel

Downtown Full Service 7.19% ^

Suburban Limited Service 8.56% ^

Focused Service 7.98% ^

Read the full report at cbre.ca.

InnVest Hotels has acquired The Algonquin Resort St. Andrews by-the-Sea, Autograph Collection and The Algonquin Golf Course.

The new owners of the famed Windermere House hotel and resort on Muskoka’s Lake Rosseau intend to revitalize the building and its amenities while preserving the property’s historical integrity.

Proactive Hospitality has acquired the Coast Osoyoos Beach Hotel, B.C. CFO Capital arranged acquisition financing for the deal.

Tribute Portfolio – part of Marriott Bonvoy's extraordinary portfolio of 31 hotel brands – continues to grow its global family of characterful hotels with Honeyrose Hotel Montreal, a Tribute Portfolio Hotel, the brand's…