Philip Mondor

President and CEO . Président et chef de la direction

613.231.6949 x 228 | tourismhr.ca |

Overall, tourism employment sees an uptick as the industry builds momentum toward recovery in the coming months; however, growth is hindered...

Overall, tourism employment sees an uptick as the industry builds momentum toward recovery in the coming months; however, growth is hindered by employment losses in the accommodations industry and a higher than anticipated unemployment rate in transportation.

LABOUR FORCE

The number of people available or looking for work

MARCH 2022 = 1,886,900

MARCH 2019= 2,117,700

Labour Force Survey data released for March 2022 shows positive signs toward industry workforce recovery. At 1,886,900 workers, Canada’s tourism labour force hovers slightly above the 1,878,900 workers that made up the industry as the first significant impacts of the COVID - 19 pandemic were felt in the industry that same month in 2020. (1,2.)

However, when considering the robust tourism labour force pre-pandemic—a sizeable 2,117,700 workers in March 2019—it remains clear that labour shortages remain across the country and throughout the tourism industries though indicators, such as positive changes in the monthly unemployment rate, reveal that momentum is building toward industry recovery.

1: As defined by the Canadian Tourism Satellite Account. The NAICS industries included in the tourism sector are those that would cease to exist or operate at a significantly reduced level of activity as a direct result of an absence of tourism.

2: SOURCE: Statistics Canada Labour Force Survey, customized tabulations. Based on seasonally unadjusted data collected from March 20 to March 29, 2022.

March 2022 Tourism Employment = 9.2 per cent of the Canadian Workforce

EMPLOYMENT

The number of people in jobs

MARCH 2022 = 1,784,500

FEBRUARY 2022 = 1,756,000

Tourism employment comprised 9.2 per cent of the total Canadian workforce for March 2022—hovering at the same level as the previous month (9.1 per cent). Tourism employment increased slightly by 28, 500 (or 1 .6 per cent) from the previous month. Total employment now sits at 1,784,500 (up from 1,756,000 in February). Employment numbers have seen significant positive change since March 2021 (mid-pandemic) for all industries except for travel services.

While employment in the tourism industry is still behind the levels seen pre-pandemic in March 2019, the travel services workforce remains one of the hardest hit.

For the second straight month, the unemployment rate in the tourism industry stood at 5.4 per cent, which is below Canada’s seasonally unadjusted unemployment rate of 5.7 per cent for this month and 7.6 percentage points lower than the rate reported for tourism a year ago in March 2021 (13.0 per cent). All tourism industry groups have reported lower unemployment rates than the same month last year. However, both the accommodations and transportation industries saw higher unemployment rates than last month.

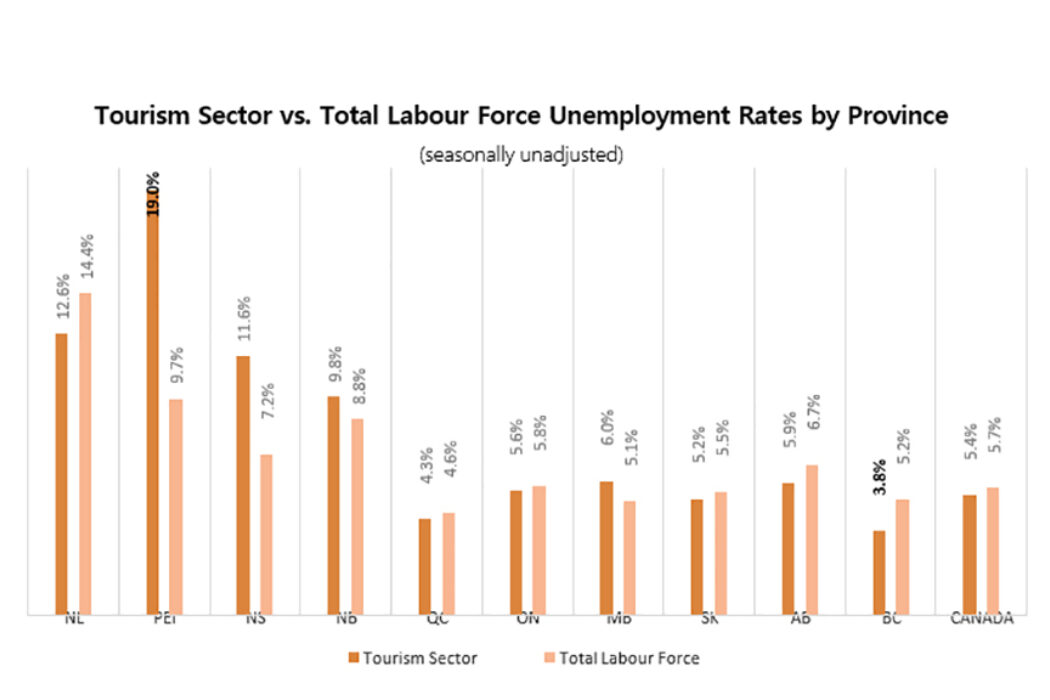

On a provincial basis, tourism unemployment rates ranged from a low of 3.8 per cent in British Columbia to 19.0 per cent in Prince Edward Island. The seasonally unadjusted unemployment rates for tourism in each province, except for Prince Edward Island, Nova Scotia, New Brunswick, and Manitoba were below the rates reported for the provincial economy.

The employment increase in March is due to increases in full-time employment. Part-time employment in the tourism industry declined slightly (- 4,400) after major gains in the previous months, while full-time employment increased by 33,000.

Looking Forward

The first two months of 2022 have brought positive indications that employees are returning to tourism occupations. However, the drop in employment in the accommodations industry implies that a high level of volatility remains. Further to this, the suppressed employment numbers in travel services that have persisted throughout the pandemic failed to see positive movement this past month though external factors, such as the public health measures that had been in place across most parts of the country, are lessening their impact on tourism activity and global research reveals positive signs that travellers are eager to return to tourism destinations. (3)

As the tourism industry looks toward Spring 2022, workforce recovery is top of mind for tourism employers and industry stakeholders. As travellers begin to return in the coming months, we should anticipate the heightened need for tourism workers across all five of the key tourism industries.

3: For example, please see the recent report Global Survey on Perspectives of Service Delivery and Traveller Priorities by Twenty31 Consulting Inc. available at www.tourismhr.ca.

InnVest Hotels has acquired The Algonquin Resort St. Andrews by-the-Sea, Autograph Collection and The Algonquin Golf Course.

The new owners of the famed Windermere House hotel and resort on Muskoka’s Lake Rosseau intend to revitalize the building and its amenities while preserving the property’s historical integrity.

Proactive Hospitality has acquired the Coast Osoyoos Beach Hotel, B.C. CFO Capital arranged acquisition financing for the deal.

Tribute Portfolio – part of Marriott Bonvoy's extraordinary portfolio of 31 hotel brands – continues to grow its global family of characterful hotels with Honeyrose Hotel Montreal, a Tribute Portfolio Hotel, the brand's…